Affordability Boost

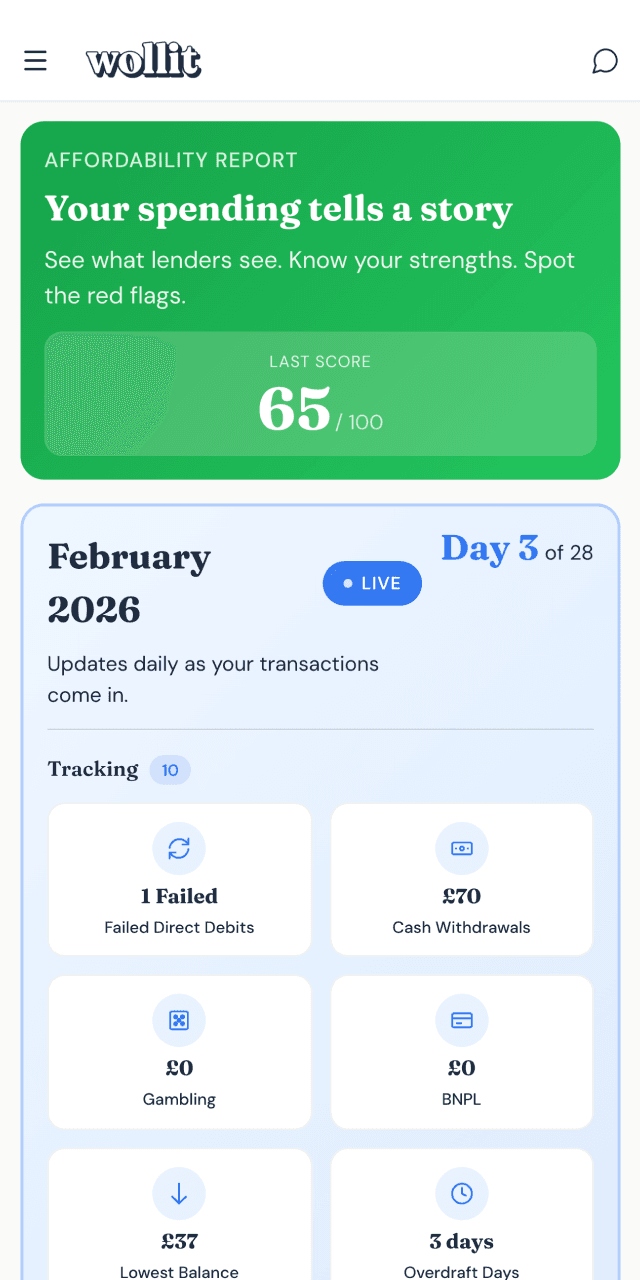

See what lenders see.

Before you apply.

Your spending tells a story. Make sure it's the right one.

Check my affordability

Know your strengths. Spot the red flags. Fix them first.

Lenders analyse your bank statements to decide if you're creditworthy. We show you exactly what they look for — and how your spending stacks up.

See through their eyes

Understand the spending patterns lenders care about

Spot risky patterns

Identify habits that could hurt your application

Improve before you apply

Fix issues while there's still time

What we analyse

The spending patterns lenders look at when assessing affordability

Money in

GoodMoney out

GoodMoney in vs out

GoodGambling

GoodBNPL spending

GoodOverdraft days

Needs workFailed Direct Debits

Needs workCash withdrawals

Needs workLowest balance

Needs workWhy affordability matters

Lenders check more than credit scores

Banks and lenders increasingly use Open Banking to see your actual spending. A good credit score isn't enough if your spending raises red flags.

Rejections leave a mark

Every failed application shows on your credit file and makes the next one harder. Better to fix issues before you apply than after you're rejected.

Small changes, big impact

Sometimes it's simple fixes — reducing gambling, avoiding overdrafts, building a buffer. Know what to focus on and when you're ready to apply.

Get started in 2 minutes

1. Link your bank

Connect securely via Open Banking.

2. We analyse your spending

Check patterns lenders care about.

3. See your insights

What's working, what's not, and how to improve.

Explore all features

Rent Reporting

Your rent counts towards your credit score.

Affordability Boost

See what lenders see before you apply.

Credit Smart

Learn credit in 5 minutes a day. Earn rewards.

Olli AI

Got a credit question? Ask Olli.

Credit Wins

Find payments that could build your credit.

Payment Reporting

Every payment builds your credit history.

Don't let your spending let you down

See what lenders see. Fix it before you apply.

Get startedCancel anytime. No credit check to sign up.